The Advantages of Long Term Rental Loans for 1-8 Unit Properties

The single family rental market is booming. With low interest rates and high demand for housing, the prices of homes have soared along with market rents.

It’s time for real estate investors to take advantage and they can do so with a Long Term Rental Loan.

Speed

Traditional banks are swamped with consumer refinances from borrowers looking to take advantage of the low interest rates. Refinances that used to take 30-45 days are now on a 60-90 day horizon.

With a Long Term Rental Loan, investors can close in 30 days and increase their liquidity faster to purchase more assets.

Ease

Many lenders will require tax returns and pay stubs to verify income during their loan process. With a Long Term Rental Loan, investors can avoid jumping through hoops because income verification is not needed.

There are also lenders who have high debt coverage ratios that are calculated by taking the property owner’s income and analyzing it against all their direct and guaranteed debt obligations. With a Long Term Rental Loan, borrowers have more flexibility and can qualify with a DSCR of 1.0 or higher.

Lastly, some lenders require a borrower to vest in a newly formed special purpose entity to be formed. However, that is not required for portfolios with 9 or fewer properties with a Long Term Rental Loan.

Unlimited Loans

A real estate investor can only have up to 10 Fannie Mae loans at a time. As such, if a borrower has 10 loans and wants to buy a new property, then they need to restructure their existing debt in order to obtain a new conventional loan from a bank.

Long Term Rental Loans are not capped. Real estate investors can have as many as they want.

Overall

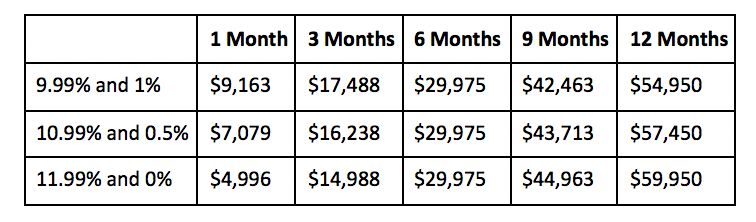

At Conventus, we are excited to offer a product of single family Long Term Rental Loans and can make exceptions for 5-8 unit properties. We can fund bridge loans for borrowers to lock up properties quickly and then they can refinance into the Long Term Rental Loan product with a discount for rolling over. Please reach out if you have any loans you would like to discuss.

by Jared Newman | jared@cvlending.com

Jared is a Loan Officer for the hard money lender Conventus, LLC and has been working in real estate since 2016. He is about to start an investment portfolio of his own with rental properties

Disclaimer

The information provided in Conventus BLOGs and accompanying material is for informational purposes only. It should not be considered legal or financial advice. You should consult with an attorney or other professional to determine what may be best for your individual needs. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. Conventus does not make any guarantee or other promise as to any results that may be obtained from using our content. Conventus makes no representations as to the accuracy, completeness, correctness, suitability, or validity of any information on this site and is not liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Content contained on or made available through the website is not intended to and does not constitute legal advice or investment advice and no attorney-client relationship is formed. Your use of the information on the website or materials linked from the Web is at your own risk.